are political donations tax deductible uk

The federal government allows various deductions. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Nonprofit Tax Programs Around The World Eu Uk Us Are Political Contributions Tax Deductible H R Block 63stfuv Kpqwm Difference Between Charity Business Administration.

. 75 percent of the original 200 50 percent of the next 900 and 33 percent of the next 1200 are capped at 1000 per participant. How this works depends on whether. 1500 for contributions and gifts to political parties.

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. If you go over 400 from 400-750 is a 50 tax credit and from 750-1175 is 333. All contributions are eligible for a credit of either 75 percent for each 200 contributed 50 percent.

Political donations made by individuals are not tax-deductible in Britain. If you are not tax exempt and contributed charitable donations to a qualified organization you could claim a tax deduction. How Much Deduction Is Eligible For Donation To Political Party.

Donations by individuals to charity or to community amateur sports clubs CASCs are tax free. You cannot deduct money you contribute to politicians or political parties from your taxes as defined by the IRS. This is called tax relief.

Nevertheless a large number of donations to UK political parties are made by companies and benefit from deductibility from corporation tax. Reuters is the first to measure the loophole which offers political parties and in some cases individual. How Much Political Contribution Is Tax Deductible.

Helping business owners for over 15 years. Zee March 2 2022 Uncategorized No. If a donor makes money as salary or dividend and then donates it they have to pay income tax.

These business contributions to the political organizations are not tax-deductible just like the individual. To be precise the answer to this question is simply no. Millions of pounds in donations to political parties a Reuters analysis has found.

According to Intuit by TurboTax political contributions arent tax-deductible While charitable donations are generally tax-deductible any donations made to political. How Much Charitable Giving Is Tax Deductible Uk. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

Subscriptions for general charitable purposes and those to for example political parties are. Are political donations tax deductible uk Are Donations to Political Campaigns Tax Deductible. Political donations made by individuals are not tax-deductible in Britain.

This paper argues however that such. However in-kind donations of goods to qualified. Things To Know.

S341 Income Tax Trading and Other Income Act 2005 S541 Corporation Tax Act 2009. Equipment or trading stock items it makes or sells land property or shares in another. With section 80GGB this allows the Company to deduct 100 of the donations it makes to political parties.

The simple answer to whether or not political donations are tax deductible is no. There are three levels of tax credits. The tax goes to you or the charity.

However there are still ways to donate and plenty of people have been taking advantage of. Your limited company pays less Corporation Tax when it gives the following to charity. As tax time approaches political contributions can lead to higher tax rates.

You live in England and Wales you are entitled to 80p worth of tax relief each donatedTaxes from high taxpayers have a 60p. How Much Political Contribution Is Tax Deductible. A donation to a federal state or.

To sum it up if you gave 1175 donation to your political party of choice you would get.

Donate Crypto And Lower Your Tax Bill Koinly

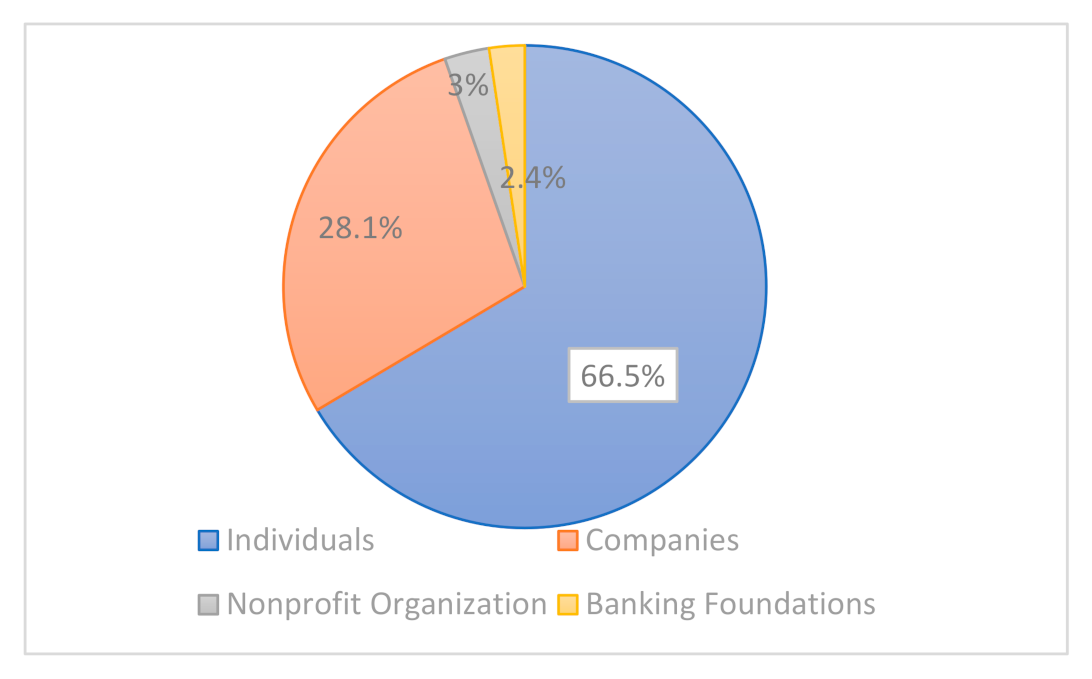

Sustainability Free Full Text Financing Sustainability In The Arts Sector The Case Of The Art Bonus Public Crowdfunding Campaign In Italy Html

Tax Deductible Donations Can You Write Off Charitable Donations

How Much Should You Donate To Charity District Capital

Nonprofit Tax Programs Around The World Eu Uk Us

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Tax Deductions For Donations In Europe Whydonate

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Tax Deductions For Donations In Europe Whydonate

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Tax Deductions For Donations In Europe Whydonate

Deduction For Donations Given To Political Parties Financepost

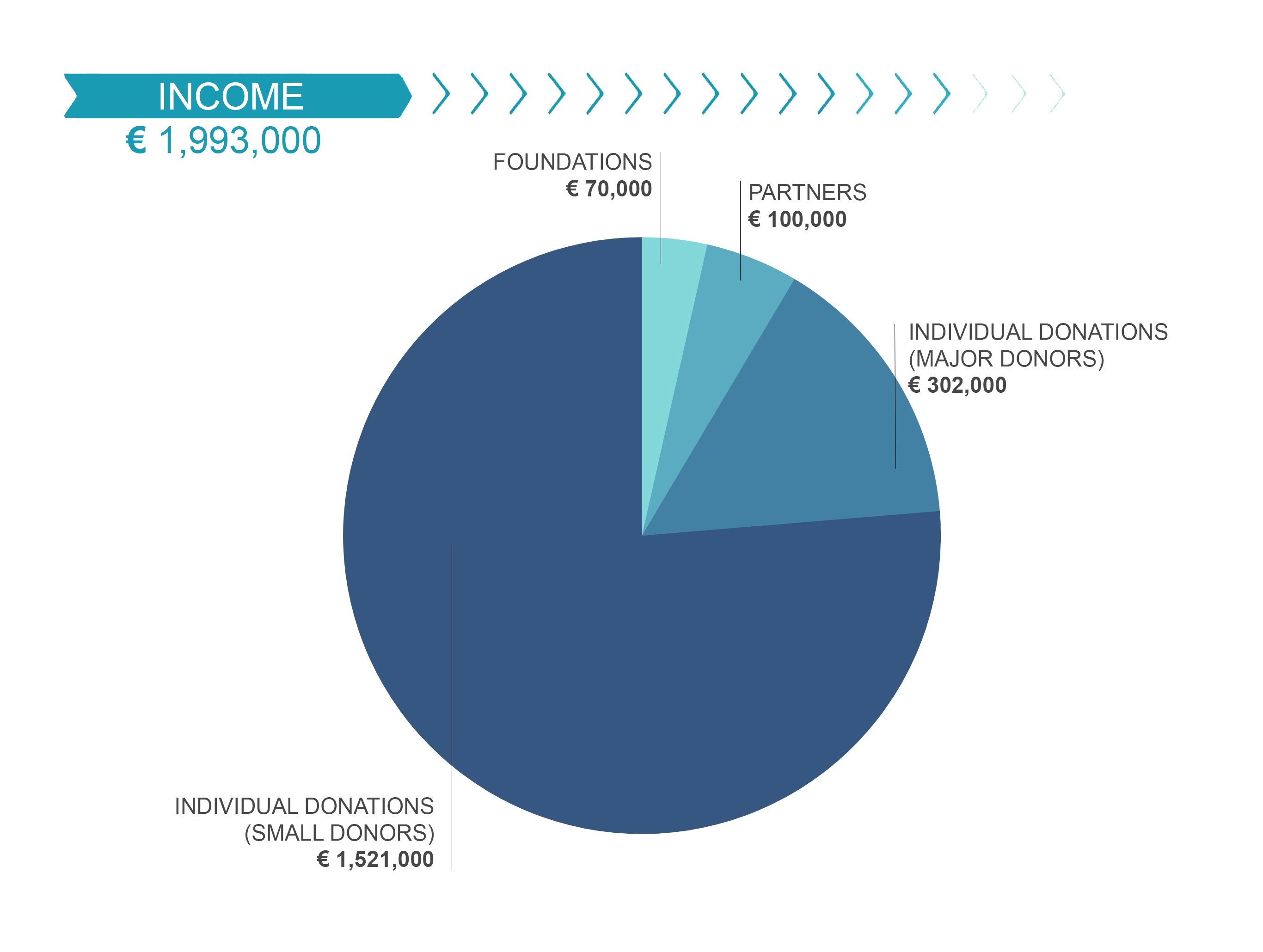

Tnt Post S Infographic Our Donations What Who And Why Infografia Solidaridad

Difference Between Charity Business Administration Think Tank

Linking Problems To Solutions Overview Download Table

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News